Commercial Real Estate Financing: How to Fund Any Deal Easily

When doing commercial real estate financing you sometimes have to be strategic about your approach. It used to feel like an insiders only game. Unless you already had millions in the bank or a relationship with a lender who owed you a favor, most opportunities were out of reach.

Most people still think commercial real estate is reserved for the ultra wealthy, or institutional investors with millions in the bank. That’s the lie that keeps regular people locked out of the most profitable asset class in existence.

Commercial real estate financing options have evolved dramatically, and the investors making serious money right now aren’t necessarily the ones with the deepest pockets. They’re the ones who understand how to structure deals intelligently and strategically.

The financing landscape has shifted in a massive way. Today’s investors have more leverage, more flexibility, and more ways to get deals funded than ever before.

If you understand the options available, from the bank’s traditional products to creative off market solutions, you start engineering your success.

If you’ve been sitting on the sidelines wondering how to get into real estate with no money, or limited capital, this is your roadmap.

We will show you how different investors use these options so that you can move faster, compete stronger, and pull profits out of deals other people don’t even notice.

Here is the essential breakdown of the financing landscape that separates the everyday landlord from the portfolio builder.

Traditional Isn’t the Only Path Anymore

Banks still play a role, but they’re not the default solution for commercial projects. Their guidelines are slow, strict, and designed for people who already have a track record. The real advantage comes from knowing how to use a wider mix of commercial real estate financing options to build momentum.

Private capital, seller agreements, layered strategies, and creative deal structures are now the fuel behind many winning acquisitions, especially for investors who want to scale quickly.

For many deals, the journey starts with the conventional path such as the traditional mortgages offered by banks, credit unions, and national lenders. These loans are vital for properties like stabilized apartment complexes or retail centers, offering the lowest interest rates and the longest terms.

However, commercial financing differs sharply from residential loans. Banks will scrutinize the property’s ability to generate income (Debt Service Coverage Ratio, or DSCR) far more than your personal finances. While traditional funding provides stability, the underwriting process is slow, requires extensive paperwork, and often limits your leverage, demanding 20-30% down. Knowing this benchmark is crucial, as it provides the baseline against the way all other creative financing options are measured.

1. Seller Financing: The Most Underestimated Power Move

Seller financing isn’t just for land or distressed properties. Commercial owners use it to move deals fast, lower their tax hit, and earn interest at the same time.

For you, it means:

- Little (or sometimes no) money upfront

- Easy negotiations

- A flexible repayment structure

- No bank breathing down your neck

It’s one of the rare strategies where both sides win, and it instantly reduces the biggest barrier to entry, which is capital.

Seller financing is exactly what it sounds like. The property owner acts as the bank. Instead of going through a traditional lender, you negotiate terms directly with the seller. They carry the note, you make payments, and everyone wins.

The seller therefore gets a reliable income stream and tax benefits, and you, the investor, get favorable terms, little to no closing costs, and get a massive competitive advantage.

This strategy is especially prevalent in niche markets, such as land, where traditional banks are hesitant to lend. Mastering the art of negotiation and contract creation for these deals gives you more control.

When structuring complex deals like Seller Financing, speed is everything. You can’t afford printing, scanning, and emailing delays.

The most successful investors use a dedicated **secure digital signing platform** to send, negotiate, and execute agreements in minutes, not days.

**Click Here To Start your 7 Day Free Trial** of the essential electronic signing software used by

top investors.

Disclosure: This post may contain affiliate links, which means I may earn a small commission if you purchase through my links at no additional cost to you. .

You may wonder why would a seller agree to this, and it’s because either they want out, they want consistent income, or they’re trying to defer capital gains taxes. It happens more often than you’d think, especially with older owners who’ve held properties for decades.

The beauty of seller financing is speed and flexibility. No credit checks. No bank underwriting hell. You negotiate the interest rate, down payment, and terms based on what works for both parties. If the seller wants 10% down instead of 25%, that deal just became accessible to someone with $50,000 instead of $125,000.

2. Private Money Lenders: Speed, Flexibility, and Zero Bureaucracy

When seller financing isn’t an option, private money lenders fill the gap. These aren’t banks, they’re individuals or small groups who lend their own capital in exchange for higher interest rates and solid collateral.

These lenders are the backbone for:

- Value add properties

- Short term holds

- Bridge deals

- High ROI commercial flips

If you know how to build relationships with private lenders, you’ll never worry about missing a profitable deal again.

When speed, flexibility, and high leverage are needed, successful investors turn to private money lenders. These are individuals or small groups who fund real estate deals based primarily on the asset’s value and the investor’s track record, rather than the borrower’s credit score.

Private money loans are typically shorter term (6 to 24 months) and carry higher interest rates, but they are absolutely essential for quick transactions, rehabilitations, and opportunities where banks simply won’t lend.

Building a solid network of private money lenders is perhaps the most valuable skill in real estate because it gives you the speed and capital required to dominate niche markets.

Private lenders care about one thing: the deal. If the numbers work and the property has strong fundamentals, they’ll fund it. They’re not bogged down by certain regulations or committee approvals, and deals close in days, not months.

The caveat is higher interest rates. Private lenders will typically charge 8-12% interest compared to 5-7% from traditional banks. But speed and flexibility often make it worth the premium, especially when you’re competing for a property in a hot market.

Why Commercial Real Estate Beats Residential Every Time

Commercial properties such as office buildings, retail centers, industrial warehouses, and apartment complexes typically generate significantly higher returns than single family rentals.

They usually have 8-12% cap rates versus 4-6% on residential. The cash flow is stronger, leases are longer, and tenants often cover maintenance costs.

But the problem is that traditional bank financing requires massive down payments, perfect credit, and extensive documentation that can drag on for months. Most people hit that wall and quit before they even start.

That’s where creative financing enters the picture.

3. Creative Financing: Where Investors Turn One Deal Into Three

Creative financing is the strategy seasoned investors use to beat the competition.

Here’s where things get interesting. The smartest investors don’t rely on one financing method, they stack multiple creative financing strategies to minimize cash out of pocket, and maximize their returns.

Beyond standard and private loans lies a world of creative financing strategies that allow you to structure complex deals for maximum profit. This includes techniques like assuming an existing mortgage, using subject to deals, or forming strategic partnerships.

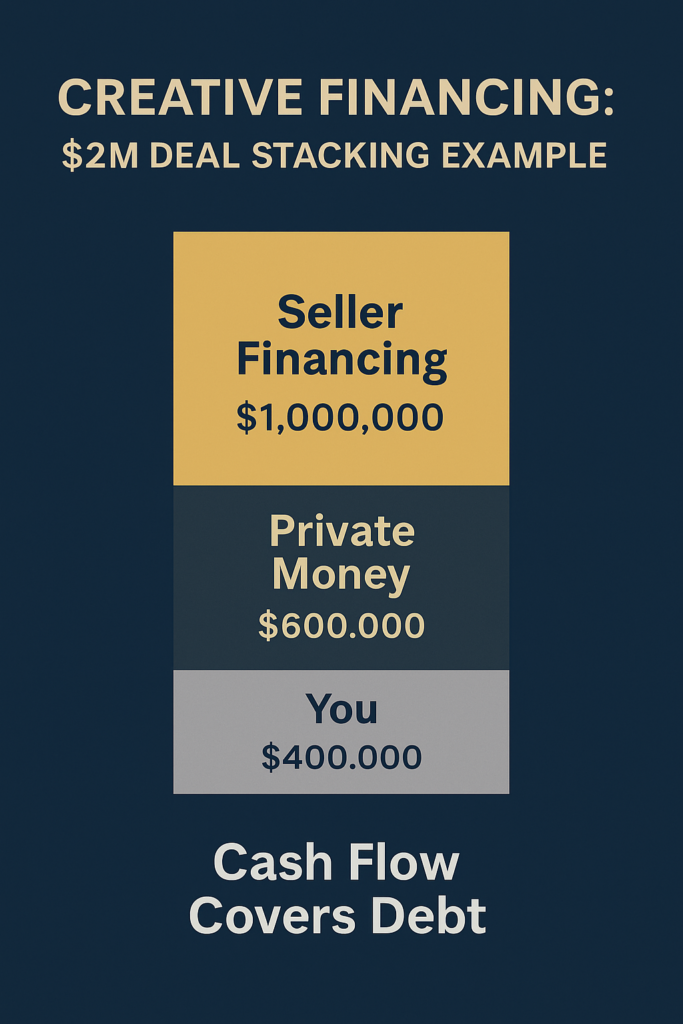

For example, let’s say you find a $2 million apartment building. The seller agrees to carry 50% ( $1 million ) through seller financing. You bring in a private money lender for 30% ( $600k ) You put down 20% yourself ( $400k ). Suddenly, a deal that required 25% or $500,000 down, now only needs $400,000, and you’ve structured it so cash flow covers debt service immediately.

This is how people with modest capital compete with institutional buyers. It’s not about having the most money, it’s about structuring deals creatively so your capital goes further.

There are many ways you can do creative financing such as:

- Combining private capital with a seller note.

- Using lease options or master leases.

- Partnering with equity investors.

- Leveraging business credit to strengthen a deal.

These approaches open doors when traditional methods hit a wall. And in competitive markets, creativity is what separates the buyers from the bystanders.

Success in creative financing relies on legal knowledge, as well as having negotiation skills. It allows you to close deals others can’t touch, often by exploiting overlooked details in the structure.

3.5. Run Your Numbers: Does Your Creative Structure Actually Work?

The $2M apartment example above proves that creative financing works, but only if the math works also.

Before you approach a seller about financing or pitch a private lender, you need to verify:

- Whether your layered debt structure improves cash on cash returns

- If the property’s income covers your stacked debt payments (DSCR)

- How different financing combinations compare side by side

This is where most beginners freeze and get paralyzed. They find a property, get excited about creative financing, then realize they have no idea if the numbers actually work.

**Here’s what the pros do:

- They test every scenario before making an offer.

- They model seller financing vs. traditional loans.

- They plug in different down payments.

- They see exactly how each financing layer affects cash flow in minutes.

Most investors waste days building Excel spreadsheets, and still get it wrong. Smart investors use a commercial real estate analysis platform that does the monotonous, grueling work for them.

Plug in your numbers, adjust your financing structure, and instantly see if your creative deal actually pencils. Most investors waste days building Excel spreadsheets (and still get it wrong). Smart investors use a commercial real estate analysis platform that does the heavy lifting for them. Try it free here and use code **BESTDEAL** for 20% off your subscription.

Try it for Free Here!

(Use Code BESTDEAL For 20% off your subscription.)

Stop guessing, and start knowing whether your deals will make you money before you sign anything.

4. OPM (Other People’s Money): The Real Engine Behind Big Deals

Every major commercial real estate empire was built using OPM.

Other People’s Money is the foundation behind:

- Seller financing

- Private money

- Hard money

- Equity partnerships

- JV deals

- Master lease options

- Assignable contracts

- Debt stacking

- Creative financing combinations

OPM is simply the art of controlling assets without tying up your own cash.

If you understand how to leverage OPM, you can scale faster than investors who are still trying to save for every down payment.

OPM lets you:

- Fund deals you couldn’t qualify for traditionally.

- Reduce your personal risk.

- Increase leverage.

- Close more deals with less capital.

- Multiply your returns using other people’s unused capital.

With Other people’s money (OPM) you’re not borrowing money just to buy properties.

You’re structuring deals that turn other people’s idle cash into predictable returns,

while you build equity, appreciation, and cash flow.

This is how investors with no money suddenly control millions in assets.

Once you understand how OPM works, commercial real estate becomes a game of strategy, not savings.

5. How to Get Into Real Estate With No Money (Yes, Really)

It’s not a fantasy, it’s a strategy that investors use every day.

Here are some examples of how to get into real estate with no money:

- Seller financing with low, or no down payments.

- Partner deals where you bring the opportunity, and someone else brings the capital..

- Assignable contracts.

- Private money backed offers.

- Equity splits in exchange for management or expertise.

If you’re resourceful, you can make your first move long before you have the cash.

Final Thought: Access Always Beats Cash

The investors who scale the fastest aren’t the ones with the most money, they’re the ones who understand how financing works.

When you master seller financing, private lenders, and creative deal structures, commercial real estate starts looking like a roadmap.

The old model of real estate investing that carries the expectation of saving for years, get a bank loan, buy one property at a time is dead. The new model is about understanding commercial real estate financing options and using them strategically to move faster, and scale bigger.

Whether it’s seller financing, tapping into private money lenders, or learning how to get into real estate with no money through pure deal structuring, the opportunities are out there, and they exist. The question is whether you’re willing to learn the game wealthy investors have been playing for decades.

If you master the entire capital stack, you can guarantee your ability to fund any profitable deal that comes your way.

Once you know how to access capital, everything else becomes an opportunity. Stop waiting for permission, and start structuring deals.

Ready To Structure Your First Commercial Deal With Clarity?

Run the math in minutes and save time and headaches. This tool will show you instantly whether your deal works or not. It does this without spreadsheets, formulas, or hours of calculating numbers by hand.

Click Here To Try It Free Now

Be Sure To Use Code: BESTDEAL for 20% Off If You Decide To Upgrade

If you enjoyed this article, be sure to also read up on “Real Estate Crowd Funding Platforms” to give you more inspiration in your real estate investing.